STARTING AT $1/Day

Affordable, Reliable Auto Insurance for Every Driver

Finding the right auto insurance shouldn’t be complicated or expensive. We help drivers connect with top-rated providers to get the best coverage at the most competitive rates—quickly and hassle-free.

Whether you're looking for better coverage, lower rates, or exclusive discounts, our network of trusted insurers ensures you get the protection you need at a price that makes sense.

Get a personalized quote in minutes and start saving today.

PROTECT YOUR VEHICLE & SAVE

Affordable Auto Insurance Made Simple

Many drivers overestimate the cost of auto insurance and end up paying more than they should. Finding the right coverage can be confusing, but we make it easy.

We connect drivers with trusted providers to help them find the best policy for their needs—starting as low as $51/month.

Compare your options and start saving today.

MORE FOR LESS

Why do people get Auto insurance?

Auto insurance is a way to protect yourself and your vehicle from financial loss in case of an accident, theft, or damage. Auto insurance can cover repair costs, medical expenses, liability claims, and even legal fees, ensuring that you and your family stay financially secure on the road.

Only recommend certified partners

You're in good hands

Highly Rated

In-Depth Review

In-Depth Review

How It Works

You're in good hands

Take assessment

IgniteQuote will find your match

Get the perfect policy

How It Works

So, how does it work?

Take assessment

IgniteQuote will find your match

Get the perfect policy

IgniteQuote

Protect What Matters Most

Compare options and find the right coverage today.

Get the Coverage you deserve

Unlike other auto insurance companies that may charge high premiums with limited benefits, we offer affordable rates with comprehensive coverage. Our policies provide better discounts for safe drivers, multi-car policies, and bundled insurance plans—helping you save more compared to competitors. While some companies raise rates unexpectedly, we ensure transparent pricing with no hidden fees. Plus, our efficient claims process gets you back on the road faster, saving you time and money. With us, you get top-notch protection at a lower cost than many other providers. 🚘💵

Frequently Asked Questions

When do I need Auto insurance?

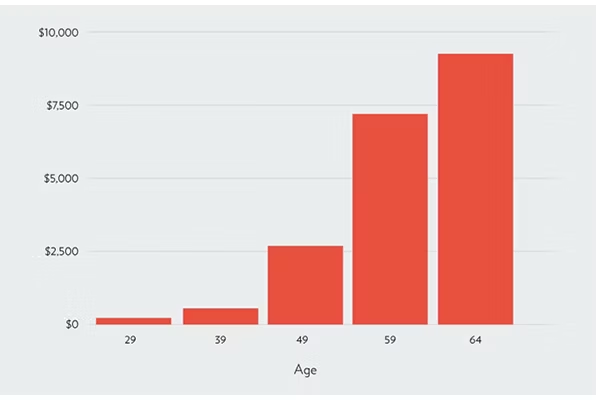

Does My Age Affect My Auto Insurance Cost?

How much do I need?

Why do people get Auto insurance?