Liability Cover - Protecting You and Others on the Road

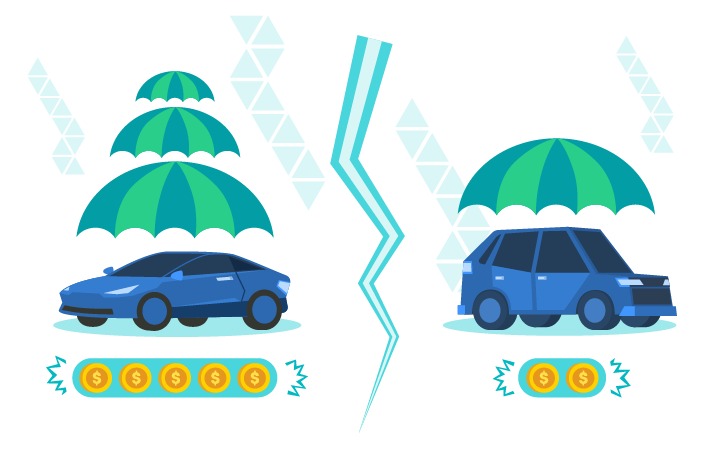

At IgniteQuote, we understand that accidents can happen at any time, and the financial burden can be overwhelming. Our Liability Coverage ensures you are protected from expensive medical bills, property damage, and legal costs if you’re responsible for an accident.

Bodily Injury Liability covers medical expenses, lost wages, and legal fees if someone is injured due to an accident you caused. This ensures that you are financially protected while helping those affected get the care they need.

Property Damage Liability covers the cost of repairing or replacing another person’s vehicle or property damaged in an accident. Without this protection, you could face thousands of dollars in out-of-pocket expenses.

Liability insurance is not just a legal requirement in most states—it’s a crucial safety net that safeguards your finances and peace of mind. With IgniteQuote, you can drive confidently, knowing you’re covered for the unexpected.